Tax Form For Investment Losses . to claim capital losses on your tax return, you will need to file all transactions on schedule d of form 1040, capital gains. How capital gains and losses work. The first rule to remember is. the schedule d form is what most people use to report capital gains and losses that result from the sale or trade of certain property during the year. You may be subject to the niit. net investment income tax (niit). learn the proper procedure for deducting investment losses and get some tips on how to strategically structure them to lower your income tax bill. losses on investments can be carried forward to offset gains in future tax years. report most sales and other capital transactions and calculate capital gain or loss on form 8949, sales and other. The niit is a 3.8% tax on the lesser of your net investment income or.

from www.formsbank.com

You may be subject to the niit. report most sales and other capital transactions and calculate capital gain or loss on form 8949, sales and other. to claim capital losses on your tax return, you will need to file all transactions on schedule d of form 1040, capital gains. net investment income tax (niit). losses on investments can be carried forward to offset gains in future tax years. How capital gains and losses work. The niit is a 3.8% tax on the lesser of your net investment income or. learn the proper procedure for deducting investment losses and get some tips on how to strategically structure them to lower your income tax bill. the schedule d form is what most people use to report capital gains and losses that result from the sale or trade of certain property during the year. The first rule to remember is.

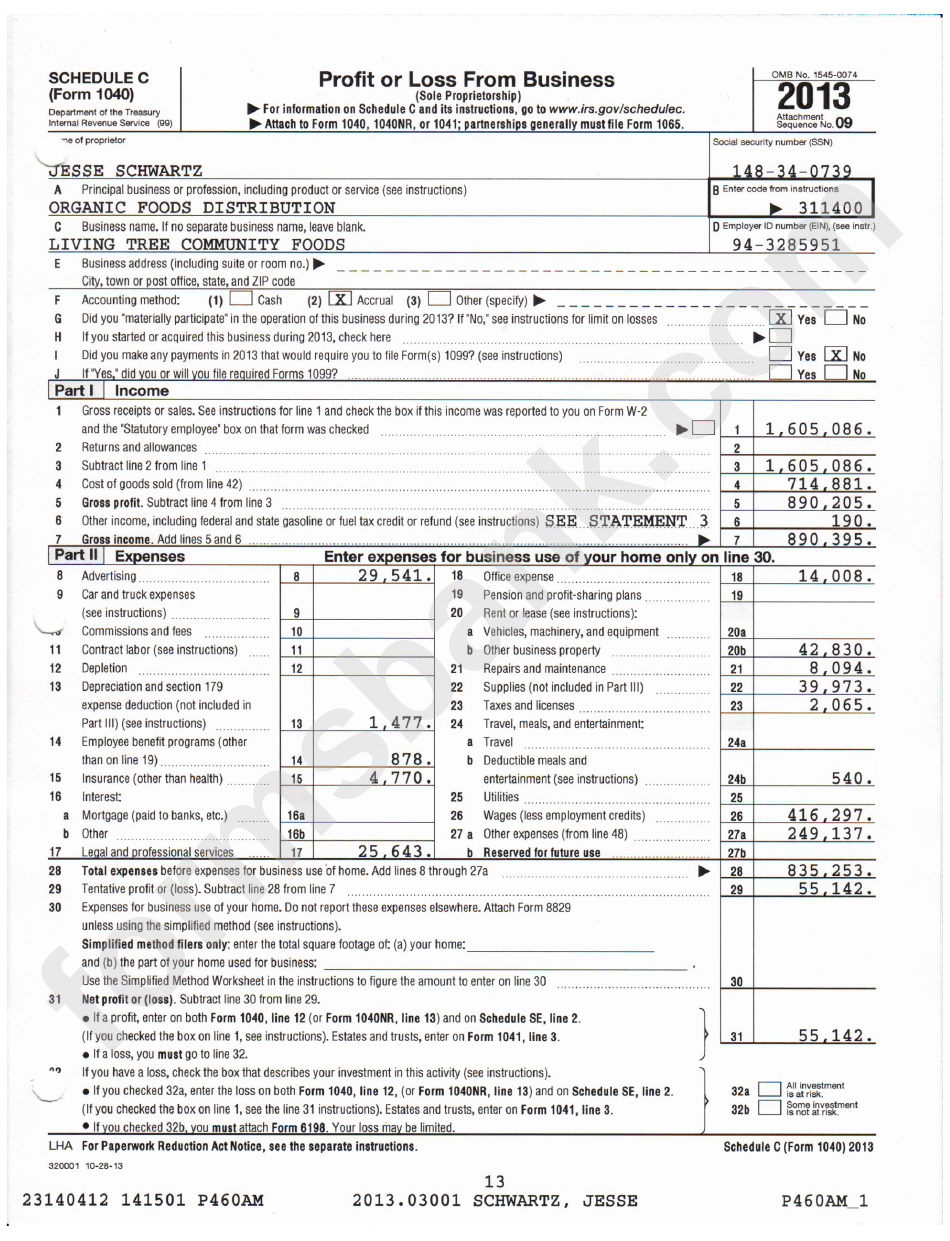

Form 1040 Schedule C Sample Profit Or Loss From Business printable

Tax Form For Investment Losses the schedule d form is what most people use to report capital gains and losses that result from the sale or trade of certain property during the year. report most sales and other capital transactions and calculate capital gain or loss on form 8949, sales and other. The first rule to remember is. net investment income tax (niit). learn the proper procedure for deducting investment losses and get some tips on how to strategically structure them to lower your income tax bill. The niit is a 3.8% tax on the lesser of your net investment income or. the schedule d form is what most people use to report capital gains and losses that result from the sale or trade of certain property during the year. to claim capital losses on your tax return, you will need to file all transactions on schedule d of form 1040, capital gains. losses on investments can be carried forward to offset gains in future tax years. How capital gains and losses work. You may be subject to the niit.

From www.worksheeto.com

8 Best Images of Profit And Loss Worksheet Business Tax Deductions Tax Form For Investment Losses The first rule to remember is. the schedule d form is what most people use to report capital gains and losses that result from the sale or trade of certain property during the year. How capital gains and losses work. learn the proper procedure for deducting investment losses and get some tips on how to strategically structure them. Tax Form For Investment Losses.

From www.templateroller.com

Download Instructions for IRS Form 1040, 1040SR Schedule D Capital Tax Form For Investment Losses learn the proper procedure for deducting investment losses and get some tips on how to strategically structure them to lower your income tax bill. The niit is a 3.8% tax on the lesser of your net investment income or. net investment income tax (niit). You may be subject to the niit. The first rule to remember is. . Tax Form For Investment Losses.

From insights.wjohnsonassociates.com

Tax Loss Harvesting How to Benefit From Your Investment Losses Tax Form For Investment Losses the schedule d form is what most people use to report capital gains and losses that result from the sale or trade of certain property during the year. The first rule to remember is. report most sales and other capital transactions and calculate capital gain or loss on form 8949, sales and other. You may be subject to. Tax Form For Investment Losses.

From www.schwabmoneywise.com

Schwab MoneyWise Understanding Form 1099 Tax Form For Investment Losses losses on investments can be carried forward to offset gains in future tax years. learn the proper procedure for deducting investment losses and get some tips on how to strategically structure them to lower your income tax bill. the schedule d form is what most people use to report capital gains and losses that result from the. Tax Form For Investment Losses.

From handypdf.com

2024 Investment Declaration Form Fillable, Printable PDF & Forms Tax Form For Investment Losses You may be subject to the niit. The first rule to remember is. losses on investments can be carried forward to offset gains in future tax years. report most sales and other capital transactions and calculate capital gain or loss on form 8949, sales and other. learn the proper procedure for deducting investment losses and get some. Tax Form For Investment Losses.

From 1044form.com

Capital Gains And Losses Schedule D When Filing US Taxes 1040 Form Tax Form For Investment Losses learn the proper procedure for deducting investment losses and get some tips on how to strategically structure them to lower your income tax bill. to claim capital losses on your tax return, you will need to file all transactions on schedule d of form 1040, capital gains. You may be subject to the niit. The niit is a. Tax Form For Investment Losses.

From www.templateroller.com

IRS Form 8960 2018 Fill Out, Sign Online and Download Fillable PDF Tax Form For Investment Losses The niit is a 3.8% tax on the lesser of your net investment income or. The first rule to remember is. net investment income tax (niit). the schedule d form is what most people use to report capital gains and losses that result from the sale or trade of certain property during the year. You may be subject. Tax Form For Investment Losses.

From schematicxandertheblue5a.z4.web.core.windows.net

How To Calculate Schedule D Tax Form For Investment Losses The first rule to remember is. report most sales and other capital transactions and calculate capital gain or loss on form 8949, sales and other. losses on investments can be carried forward to offset gains in future tax years. learn the proper procedure for deducting investment losses and get some tips on how to strategically structure them. Tax Form For Investment Losses.

From www.schwab.com

Investment Expenses What's Tax Deductible? Charles Schwab Tax Form For Investment Losses to claim capital losses on your tax return, you will need to file all transactions on schedule d of form 1040, capital gains. The niit is a 3.8% tax on the lesser of your net investment income or. learn the proper procedure for deducting investment losses and get some tips on how to strategically structure them to lower. Tax Form For Investment Losses.

From www.haasonline.com

Cryptocurrency Taxes Overview How to Report Your Gains and Losses Tax Form For Investment Losses You may be subject to the niit. learn the proper procedure for deducting investment losses and get some tips on how to strategically structure them to lower your income tax bill. losses on investments can be carried forward to offset gains in future tax years. report most sales and other capital transactions and calculate capital gain or. Tax Form For Investment Losses.

From www.formsbank.com

Form 1040 Schedule C Sample Profit Or Loss From Business printable Tax Form For Investment Losses losses on investments can be carried forward to offset gains in future tax years. net investment income tax (niit). learn the proper procedure for deducting investment losses and get some tips on how to strategically structure them to lower your income tax bill. the schedule d form is what most people use to report capital gains. Tax Form For Investment Losses.

From sample-templates123.com

P And L Template Excel Free Sample, Example & Format Templates Free Tax Form For Investment Losses to claim capital losses on your tax return, you will need to file all transactions on schedule d of form 1040, capital gains. The first rule to remember is. The niit is a 3.8% tax on the lesser of your net investment income or. learn the proper procedure for deducting investment losses and get some tips on how. Tax Form For Investment Losses.

From invertirconexito.com

¿Necesita declarar criptomonedas en sus impuestos? Aquí se explica cómo Tax Form For Investment Losses net investment income tax (niit). losses on investments can be carried forward to offset gains in future tax years. The niit is a 3.8% tax on the lesser of your net investment income or. learn the proper procedure for deducting investment losses and get some tips on how to strategically structure them to lower your income tax. Tax Form For Investment Losses.

From www.formsbirds.com

Profit and Loss Statement Form 2 Free Templates in PDF, Word, Excel Tax Form For Investment Losses The first rule to remember is. learn the proper procedure for deducting investment losses and get some tips on how to strategically structure them to lower your income tax bill. losses on investments can be carried forward to offset gains in future tax years. the schedule d form is what most people use to report capital gains. Tax Form For Investment Losses.

From www.equitystat.com

2022 8949 IRS Tax Form Released EquityStat Blog Tax Form For Investment Losses to claim capital losses on your tax return, you will need to file all transactions on schedule d of form 1040, capital gains. The first rule to remember is. The niit is a 3.8% tax on the lesser of your net investment income or. How capital gains and losses work. report most sales and other capital transactions and. Tax Form For Investment Losses.

From www.youtube.com

Chapter 11, Part 3 Tax Forms for Capital Gains & Losses YouTube Tax Form For Investment Losses learn the proper procedure for deducting investment losses and get some tips on how to strategically structure them to lower your income tax bill. How capital gains and losses work. the schedule d form is what most people use to report capital gains and losses that result from the sale or trade of certain property during the year.. Tax Form For Investment Losses.

From www.careerswave.in

[PDF} Investment Declaration Form 202122 PDF Download Tax Form For Investment Losses You may be subject to the niit. learn the proper procedure for deducting investment losses and get some tips on how to strategically structure them to lower your income tax bill. The niit is a 3.8% tax on the lesser of your net investment income or. the schedule d form is what most people use to report capital. Tax Form For Investment Losses.

From www.signnow.com

Cra T2 Short Return 20192024 Form Fill Out and Sign Printable PDF Tax Form For Investment Losses learn the proper procedure for deducting investment losses and get some tips on how to strategically structure them to lower your income tax bill. The niit is a 3.8% tax on the lesser of your net investment income or. You may be subject to the niit. report most sales and other capital transactions and calculate capital gain or. Tax Form For Investment Losses.